The Global Recycling Shift: ONE's Insights on New Trade Flows

- Nov 14, 2025

- 2 min read

As the world moves towards a sustainable, circular economy, the concept of "End of Waste" is fundamentally reshaping global supply chains. This principle establishes criteria for when waste materials become new products or raw materials, and transforms processed waste materials into commodities. Key materials like waste paper and scrap metal are at the forefront of this movement, with their international trade volumes creating new challenges and opportunities for logistics. A major realignment is underway: traditional import hubs are being replaced by growing markets in India and Southeast Asia, driven by evolving regulations and surging domestic demand. For businesses in the recycled resources market, understanding the drivers behind these new trade flows is essential for maintaining a competitive edge.

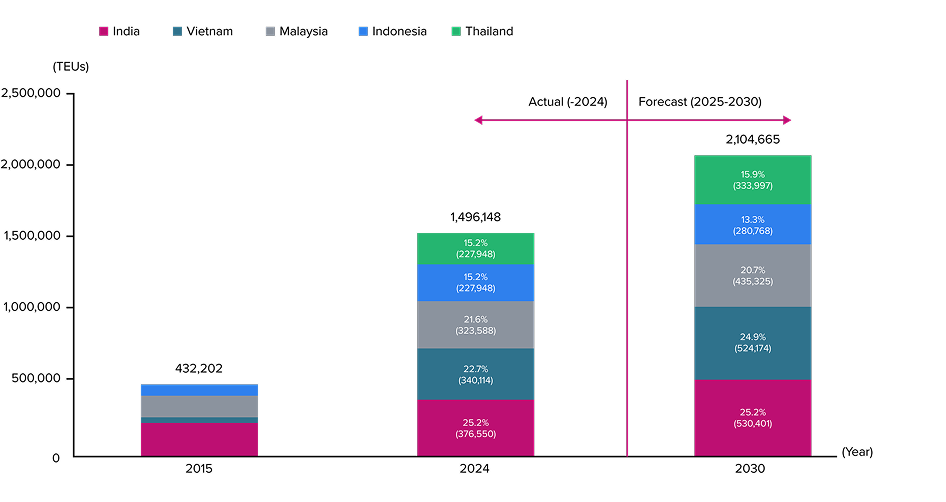

Trend and Forecast of Waste Paper Transport Volume by Container ships

Source: S&P Global Market Intelligence

Insight 1:Why is the global waste paper trade shifting to India & Southeast Asia?

The international waste paper market, with an annual transport volume of around 2 million TEUs (twenty-foot equivalent units), is experiencing a significant geographical pivot. For years, China was the dominant importer. However, in 2017, the Chinese government implemented stringent new environmental regulations, including the "National Sword" policy, which banned the import of most waste materials, including mixed paper. This significant policy shift led global supply chains to redirect vast quantities of waste paper to new markets.

Simultaneously, Southeast Asian nations and India began increasing their imports to supply their growing manufacturing and packaging industries. Similarly, booming e-commerce in Southeast Asia, particularly in Vietnam, is driving unprecedented demand for cardboard and packing materials. This shift brings new market dynamics: forecasts suggest that by 2030, India, Vietnam, and Malaysia will collectively account for over 70% of worldwide waste paper imports. Furthermore, this e-commerce driven demand spikes during holidays and major sale periods, directly impacting both material prices and shipping volume, making it a key indicator for logistics planning.

Trend of Scrap Metal Transport Volume by Container ships

Source: S&P Global Market Intelligence

Insight 2:Why is India becoming a major hub for scrap metal?

The demand for scrap metal is closely linked to steel production, and India is rapidly emerging as a global steel powerhouse. The expansion of steel demand is driven by the Indian government's strong push of infrastructure investment and domestic manufacturing initiatives such as "Make in India". These policies have stimulated steel usage across various sectors. As steel's primary applications are in the construction and automotive sectors, trends in these industries serve as leading indicators for future scrap metal demand. S&P Global Market Intelligence forecasts that India's scrap metal imports will increase at a Compound Annual Growth Rate (CAGR) of 3.1% from 2025 to 2030, making it the world's second-largest importer after Türkiye by 2030.

EAF Ratio Comparison for Major Steel Producers

Image source: one-line.com